Unlike in the Western countries, people in Asian countries still use cash for most transactions. However credit card usage is slowly increasing. With about 50% of the global population, Asia holds plenty of potential for credit card growth. MasterCard (MA) and Visa (V) accounted for 90% of volume at the end of 2007.

Credit Card Growth in China

Due to strong competition, most banks waive annual fees for cardholders. Chinese banks have to deal with low rates of revolving credit on cards since most Chinese do not carry balances on their cards. This is a huge difference from other countries where credit card issuers earn most of their profits via interest on revolving balances. Hence Chinese banks cannot easily earn high profits on credit cards. The Credit and Debit card growth rate has increased from 18% in 2004 to about 58% last year.

Source: Card payments in Asia Pacific The state of the nations, KPMG

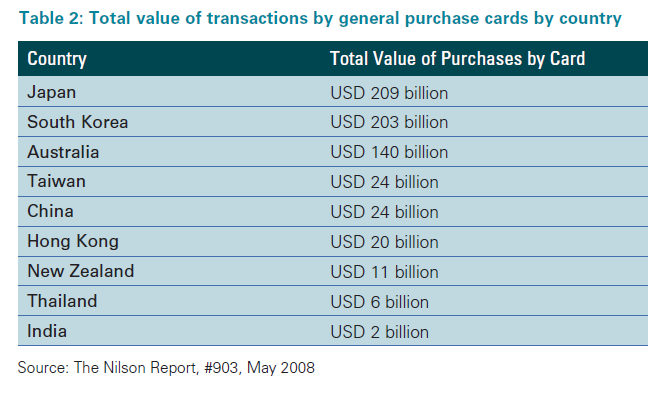

Credit Card Usage by Country:

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=da6c4e31-1fcf-4772-9476-21b9f2099efc)

0 comments