But the Web is NOT a Safe Place with which to Conduct Transactions...

But the Web is NOT a Safe Place with which to Conduct Transactions...

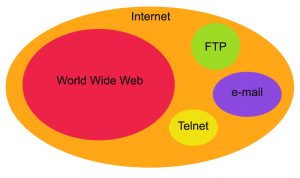

Many people use the terms Internet and World Wide Web (aka. the Web) interchangeably, but in fact the two terms are not synonymous. The Internet and the Web are two separate but related things.

How are they Different ?

The term Internet evolved from Inter-Networking.It is a massive super-network of millions of networks built all acrossthe globe. It actually represents the overall network infrastructurecomprising of Fibre optic cables, routers, switches, gateways,computers among other network constituents. Every node(computer) oninternet is accessible by every other node connected to the Internetand that’s how Internet is primarily used for communication andInformation sharing.

There are some well defined Internet protocols for performingseveral purposes such as data transfer, remote access, informationsharing using Internet. ‘World Wide Web’ employs Hyper Text Transfer Protocol(HTTP)to facilitate Information sharing on Internet. In other words, ‘Web’ issimply an Information sharing model, built on top of the internet.

In simpler words‘World Wide Web’ (WWW) or simply ‘Web’ is basically a subset of Internet. It represents the largest sub-network on Internet, which employs HTTP protocol and lets us (and hackers) access information published (or typed) on a Webpage via a software called a Web browser.

That said, it's just a matter of time before EVERYONE realizes the web is not a safe place to conduct financial transactions.. The same is true for online banking authentication. When you "type" primary card numbers or passwords, what you type can be accessed by the bad guys...

For those who missed it, I am republishing a post regarding the danger online banks face when it comes to losing customers due to inadequacies of their authentication and the web itself.

It's just a "matter of time" before EVERYONE realizes that the Web was not built for eCommerce and that if they stay on course, there will be a train wreck the magnitude of which has not been seen.

The banks have another choice...get on board the "gravy train" HomeATM can provide and open up a whole new world (wide web) of security for their customers and enchance their image, their bottom line and their branding strategy all at once.

You don't have to be a "seer" (or read "between the lines") anymore, to realize that the web is broken. You can simply read the headlines. Websense, in their new research report, pulls no punches when they state:

"The conjunction of technologies and the monetizing of hacking have resulted in a web environment where no websites, legitimate or not can be trusted."

Half of Banking Customers Hit by Card Fraud Change Banks

| |

NEW YORK, July 28, 2009 (GLOBE NEWSWIRE) -- ACI Worldwide, Inc.(Nasdaq:ACIW), a leading international provider of electronic paymentssoftware and solutions, today announced that its global card fraudsurvey revealed that 18 percent of consumers questioned have beenvictims of credit or debit card fraud in the past five years. NEW YORK, July 28, 2009 (GLOBE NEWSWIRE) -- ACI Worldwide, Inc.(Nasdaq:ACIW), a leading international provider of electronic paymentssoftware and solutions, today announced that its global card fraudsurvey revealed that 18 percent of consumers questioned have beenvictims of credit or debit card fraud in the past five years.Theresearch, of more than 2,400 consumers across eight countries, alsofound that if an individual or someone they knew was hit by card fraud,22 percent would change financial institutions, and a further 27percent would consider changing financial institutions. In the light of these findings, and the continued commitment byfinancial institutions around the world to protect their customers fromcard fraud, ACI Worldwide has launched its Guide to "Stopping CardFraud in its Tracks," with contributions from Nationwide BuildingSociety, to provide advice to fraud managers in banks to help combatcard fraud and protect their customers. Editor's Note: In the US andUK 27% or 1 in 4 people have been toasted by card fraud. Replace thetoaster with a PCI 2.x certified PED. And give them away! Cause youcare! The money will come! In fact, last time I checked (in April)the American Bankers Association said: The survey highlights some wide variations in fraud trends aroundthe world. In the US and UK, 27 percent of respondents have been hit bycard fraud in the past five years, compared to only seven percent inDubai, eight percent in Germany and 15 percent in Australia, China andSingapore. When it comes to customer attitudes to card fraud, a fifthof the respondents said they are not confident their financialinstitution can protect them, with this number rising to over a thirdin China. Editor's Note: Okay, nowif I'm in the banking industry and I read this, I wouldn't be hauntedanymore. I would be excited. Because I would see a HUGE opportunityto capitalize on these consumer behavioral attitudes. If Half wouldchange banks (even if it was just someone they knew who was hit by cardfraud) that means I have the opportunity to "lure" them to my financialinstitution. Pete Corrie, head of financial crime at Nationwide Building Society,comments: "The number of card payments globally has increaseddrastically over the past few years and, consequently, the wholeindustry has seen associated fraud levels go up. David Nussenbaum, vice president and product line manager at ACIWorldwide, adds: "The international research we have conducted showsthat although card fraud trends vary around the world, it is still apersistent problem for banks. In order to protect themselves and theircustomers against potential fraudulent attacks, financial institutionsare looking for ways to implement effective anti-fraud strategies,while maintaining efficiency and keeping costs to a minimum. We believethat our Guide will provide some useful and practical advice." The ACI Worldwide research on card fraud was conducted during July2009 in Australia, Brazil, China, Dubai, Germany, Singapore, the UK andthe USA surveying a total of 2,408 respondents. To download the ACIWorldwide Guide to 'Stopping card fraud in its tracks', go to www.aciworldwide.com/stopcardfraud.

| |

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=5451745d-db75-4f22-acaa-80dd2914d9f0)

0 comments